Apple (NASDAQ) has proposed a $100 million investment in Indonesia to establish a manufacturing plant for accessories and components, according to the country’s industry ministry. The move follows a ban on sales of Apple’s iPhone 16 due to the company’s failure to meet Indonesia’s local content requirement, which mandates that 40% of smartphone components sold domestically be locally produced.

The proposed facility in West Java signals Apple’s intent to align with the regulation and regain market access in Southeast Asia’s largest economy. The industry minister’s forthcoming meeting on Thursday underscores the government’s openness to Apple’s commitment.

Apple’s existing footprint in Indonesia includes application developer academies established since 2018, with investments totaling approximately 1.6 trillion rupiah ($99 million). This latest proposal would mark Apple’s first manufacturing presence in the country, showcasing its willingness to deepen its ties with local industries.

The ban is not exclusive to Apple; Alphabet (NASDAQ) has faced similar restrictions for non-compliance with the same regulation. These challenges highlight the increasing push by Indonesia to boost its domestic manufacturing capabilities and reduce reliance on imports.

Apple’s response to these regulatory hurdles could set a precedent for other global tech firms aiming to operate in the region, balancing compliance with local laws and maintaining competitive advantages in emerging markets.

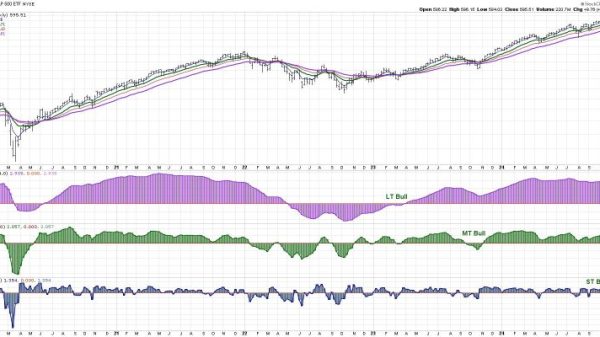

Apple Share Stock Chart

Apple (AAPL 0.11%) remains a dominant force, with a market cap hovering around $3.4 trillion after peaking at $3.6 trillion. For the tech giant to hit a $4 trillion valuation, its stock would need an 18% gain—potentially achievable given its 17% rise this year and steady financial performance.

In Q4 FY2024, Apple reported $95 billion in revenue, a 6% year-over-year increase, with Wall Street projecting mid-single-digit growth moving forward. Earnings per share are expected to rise modestly, although the impact of Apple Intelligence on future results remains uncertain.

Valuation, however, raises questions. Trading at 37 times trailing 12-month earnings—above its five-year average of 29—Apple stock may be overvalued, creating near-term risks. While the company’s dominance justifies a premium, its elevated valuation and recent pullbacks could signal caution for investors. Despite this, Apple’s steady growth trajectory keeps its $4 trillion milestone within reach.

The post Apple Shares: $100M Investment Proposal appeared first on FinanceBrokerage.